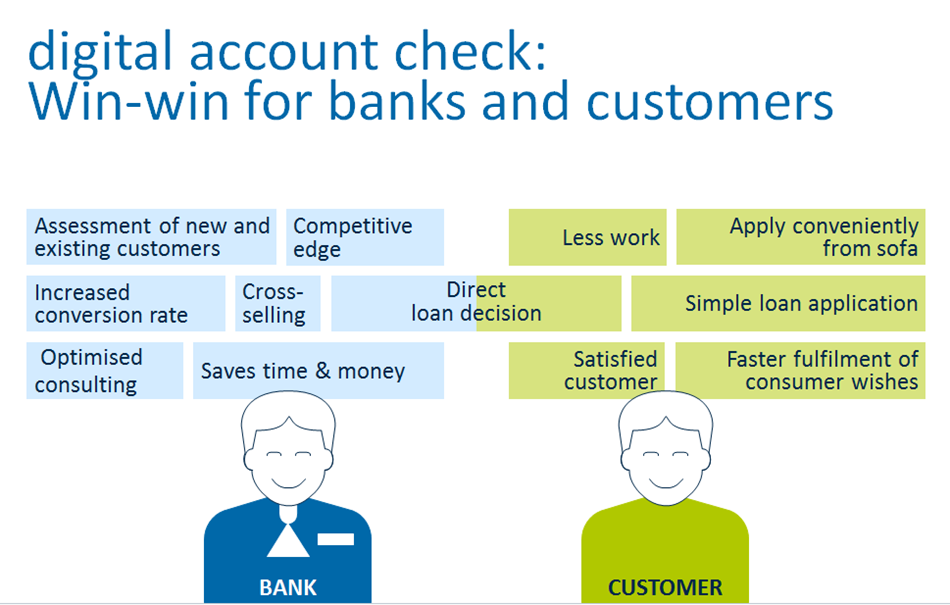

Simple loan application - maximum security

The German finance sector receives almost 25 million loan applications per year. However, in spite of a variety of optimisations in recent years, there has still been no fully automated process for processing these applications – until now.

We have developed a solution: the digital account check

The digital account check makes the loan application process easier – both online and in the branch. The solution allows the applicant to submit the relevant documentation for the transaction digitally and in real time. This can now be done without any change in media – unlike the old process, which often involved printing out statements, sending them by post and digitising them in the bank where complex checks were performed. This often led to the procedure being cancelled partway through.

The data is now also checked and thoroughly analysed in real time. A recommendation is then provided based on this analysis, allowing you to make a quick, safe decision on whether to accept the application. Your customers will also thank you for granting their loan application so quickly.

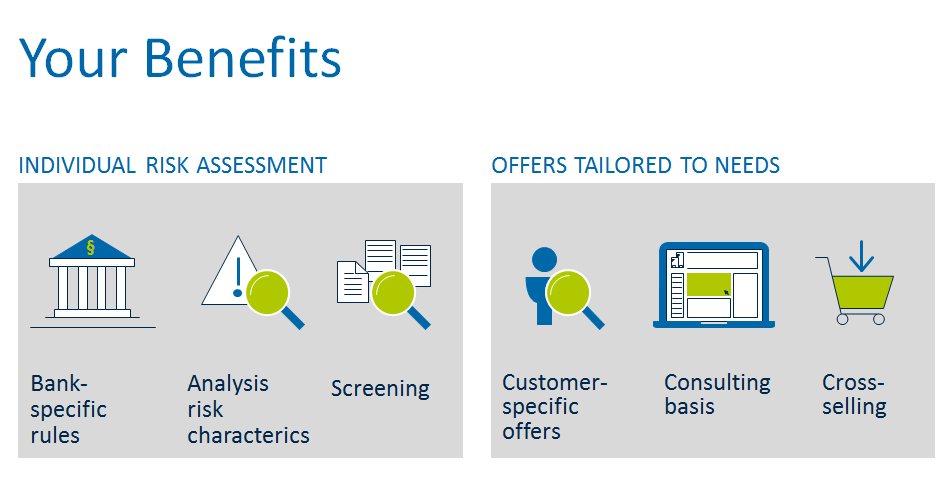

Benefits for the lending bank

• Comprehensive assessments of credit standing

• Reliable data for qualified risk assessments

• Protection against fraud

• No media break

• Seamless transferral of loan-relevant data

• Fast credit decisions with our algorithms

Benefits for the applicant

• Quickly realizes consumer demands

• Minimal waiting time for borrowers

• No inconvenient document submissions

• Fast application from home