Identity theft, stolen credit card information, fake accounts, and malware – all contribute to lost revenue for an online business. Prevent these threats with Arvato Financial Solutions’ Device Fingerprinting solution to protect your customers and your business against fraud.

What is Device Fingerprinting

Identifying legitimate and fraudulent events in your online business can easily be done by analysing the data from the very starting point of the online activity source: the device and its browser and device fingerprint.

By clearly recognising trusted devices and defined transaction patterns it is possible to automatically detect suspicious actions and to fight fraud in an early stage.

Browser Fingerprinting allows identifying the following fraud phenomena's:

- Identity theft: use of stolen personal information

- Synthetic identity: use of fake data, e.g. when applying for a credit or financing (application fraud) or creating a new account (new account fraud)

- Payment fraud: use of stolen financial information (bank account or credit card) when paying for a product or service

- Account takeover: unauthorised access to another person’s account.

Multiple device recognition including mobile phones, PCs and tablets through multiple device recognition including mobile phones, PCs and tablets

against diverse fraud risks such as application fraud, new account fraud, payment fraud, account takeover, and identity fraud

By reducing fraud rates, losses and costs, you offer an optimal and secure service for your customers and increase your conversion rate

Stop fraud and optimise the online experience for good users through reduced customer friction

Fraud Protection through device fingerprinting

The Device Fingerprinting solution allows device identification and recognition in real time without having to rely on less reliable tracking solutions such as browser cookies. It assesses every device used to make an online order or transaction and differentiates between suspicious and trusted devices.

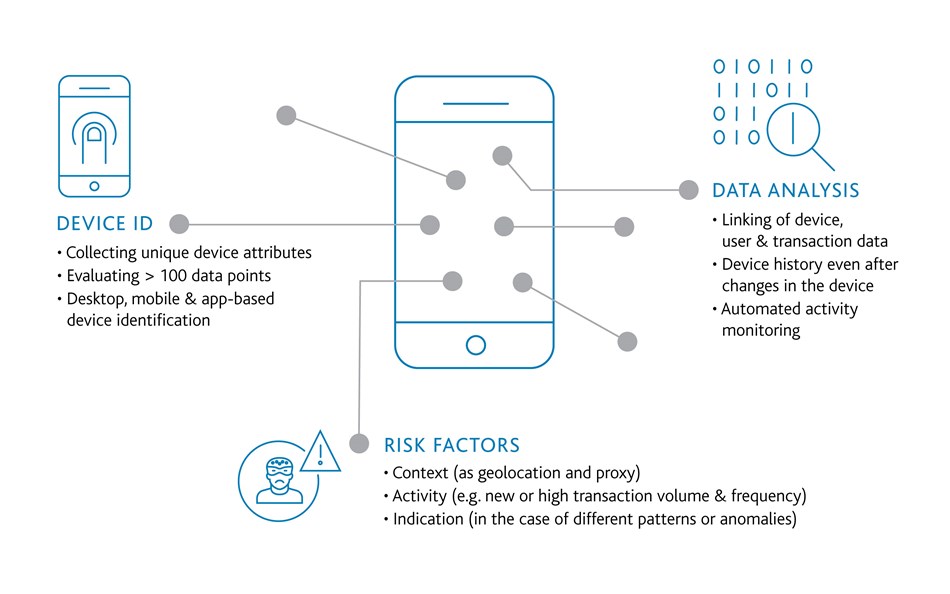

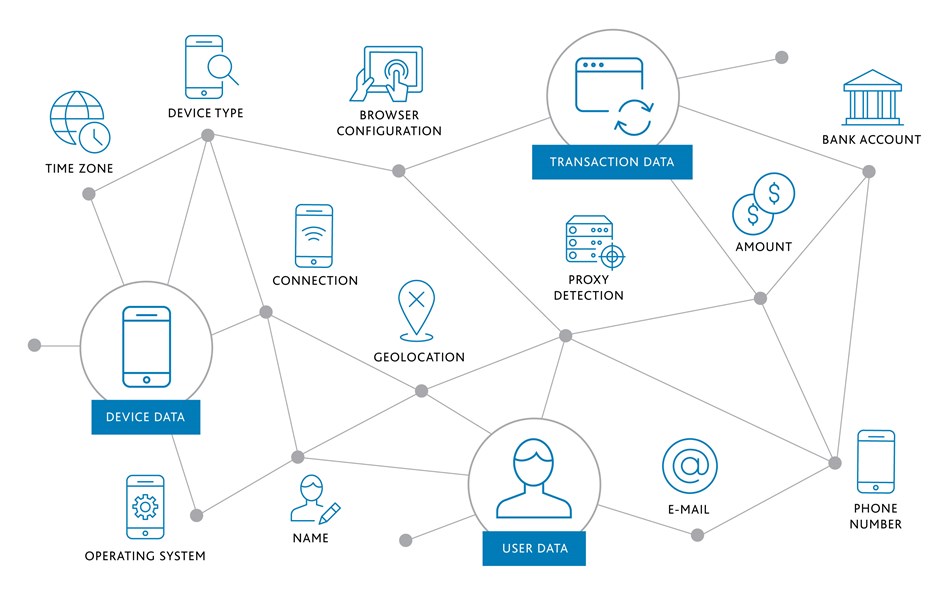

Through a special algorithm, the solution automatically generates a unique ID for each device, based more than 100 different parameters from the device’s hard- and software information, e.g. IP address, operating system, browser configuration. The device ID makes it possible to recognise the unique fingerprint of the device and compare it in real time with black and white lists.

In addition to the creation of the unique Device ID unique, the solution links and analyses the device data with user and transaction data.

Device fingerprinting can determine a user’s geographic location and detect proxy servers which are known to be a fraud risk. The device detection also works if changes are made to the device itself (e.g. through a browser or operating system updates). This makes it possible to identify potentially suspicious activity, such as changes to orders.

Arvato Financial Solutions’ Device Fingerprinting solution includes the following three dimensions: